Finding healthcare in later years is a difficult task. Understanding your benefits matters greatly. Many seniors rely on specific medical tools. These items are called Durable Medical Equipment. This category includes wheelchairs walkers and oxygen tanks. Medicare coverage for these items can seem complex. We will clarify these rules for you today.

Your health insurance should support your independence. Medicare DME coverage does exactly that. It helps you obtain necessary equipment for home. This support allows you to manage health conditions safely. Knowing your coverage empowers your healthcare decisions. Let us explore how Medicare helps you.

What is Durable Medical Equipment?

Durable Medical Equipment serves medical purposes. It withstands repeated use over time. Doctors prescribe these items for specific conditions. DME is generally suitable for home environments. Common examples clarify this definition well.

Walkers and canes assist with mobility challenges. Hospital beds support specific sleeping positions. Oxygen concentrators aid breathing difficulties. Diabetic test strips monitor blood sugar levels. Not all health-related items qualify however. Medicare dental coverage operates under different rules.

Medicare Part B: The Core of DME Coverage

Original Medicare includes Part A and Part B. Medicare Part B coverage handles DME primarily. It covers medically necessary equipment for home use. Your doctor must confirm this medical necessity. The equipment must serve a specific medical purpose.

You must acquire equipment from enrolled suppliers. Medicare only partners with certain suppliers. Your supplier must accept Medicare assignment. This means they agree to Medicare’s approved price. You will then pay your share after deductibles.

Medicare Part B coverage involves cost sharing. You typically pay twenty percent of the cost. Medicare covers the remaining eighty percent. This split applies after your annual deductible. The Part B deductible resets every year.

The Critical Role of Your Doctor

Your physician’s involvement is indispensable. They must document your medical need thoroughly. This documentation supports your DME claim. Your doctor writes a formal prescription or order.

This order must detail the equipment type. It should explain why you need this item. The prescribed use must be within your home. Medicare requires this proof before approving coverage. Always discuss DME needs with your doctor first.

Medicare Part C and DME Coverage

Many choose Medicare Advantage plans. These are also called Medicare Part C coverage. These plans replace your Original Medicare benefits. Private insurance companies provide these Medicare plans.

Medicare Advantage must cover everything Original Medicare covers. This includes all medically necessary DME. However these plans can impose different rules. They might require specific supplier networks.

Your out-of-pocket costs may differ too. Some plans offer extra DME benefits. Others might have stricter approval processes. Always check your plan’s specific evidence of coverage.

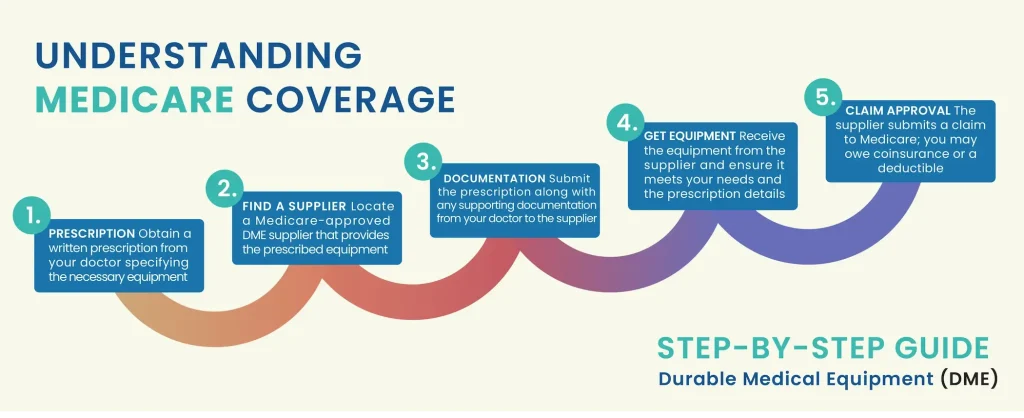

The Step-by-Step Guide to Getting DME Covered

Follow these steps to ensure coverage. First consult your doctor about your needs. Your doctor confirms the medical necessity. They will write a detailed prescription for you.

Next find a Medicare-enrolled DME supplier. Use the Medicare.gov supplier directory tool. Confirm the supplier accepts Medicare assignment. Then your supplier handles the Medicare paperwork.

Medicare reviews the submitted claim. They check your doctor’s order and supplier status. Approval leads to Medicare paying its share. You receive a bill for your portion.

What Medicare Does Not Cover

Understanding exclusions is equally important. Medicare DME coverage has clear limits. It will not cover equipment for convenience alone. Items must serve a definitive medical purpose.

Medicare dental coverage is generally separate. It does not cover routine dental care or devices. Dentures and dental implants are typically excluded. Some Medicare Advantage plans might offer dental benefits.

Medicare also denies bathroom safety equipment. Grab bars and raised toilet seats are not covered. Stairway elevators fall outside coverage rules. Same applies for disposable supplies like adult diapers.

Timing Your DME Needs

When does Medicare coverage start for DME? Your Medicare Part B must be active. You cannot get DME coverage under Part A alone. Enrollment timing is therefore critical.

Your initial enrollment period is key. This is when you first become eligible for Medicare. Missing it may lead to penalties and delays. Medicare Open Enrollment is also important.

Medicare Open Enrollment occurs each fall. This period allows you to change Medicare plans. You can switch from Original Medicare to Medicare Advantage. You can also change your Medicare Advantage plan.

This is your chance to review DME coverage. Compare different plan options carefully. Ensure your needed DME is covered adequately. Check supplier networks and anticipated costs.

Avoiding Common DME Coverage Mistakes

Many beneficiaries face avoidable problems. They rent equipment without checking coverage duration. Some use suppliers not accepting Medicare assignment. This can lead to unexpectedly high bills.

Always get a detailed written order beforehand. Verbal approvals from doctors are insufficient. Keep copies of all paperwork for your records. Do not assume all similar items are covered.

A knee brace for injury recovery is covered. A support sleeve for general comfort is not. The distinction lies in medical necessity. Your doctor must justify the medical need.

Your Action Plan for DME Coverage

Begin by reviewing your current health needs. List any equipment your doctor has recommended. Understand the difference between purchase and rental. Medicare covers some items both ways.

Talk to your doctor during your next appointment. Discuss potential DME you might need soon. Ask if they have experience with Medicare documentation. Their support is vital for successful claims.

Research Medicare-enrolled suppliers in your area. Establish a relationship before an urgent need arises. Keep your Medicare card readily accessible. Know your plan type and its specific rules.

Empowering Your Healthcare Journey

Understanding Medicare coverage reduces stress. It allows you to focus on your wellbeing. Durable Medical Equipment supports daily independence. Proper coverage makes this support affordable.

Your health insurance is a powerful tool. Use your knowledge for more benefits. Stay updated about annual Medicare Enrollment. Review your coverage and adjust as needed.

Medicare rules can change each year. Stay connected to official Medicare communications. You can manage your health with confidence and clarity. Your independence and safety are worth this effort.

FAQs

- What is the Medicare coverage gap?

This is a temporary limit on what your drug plan pays. After you and your plan spend a certain amount, you pay more for prescriptions. The good news is the gap ends each year. - What happens when I’m in the coverage gap?

You’ll pay a bit more for your prescriptions—25% of the cost for most drugs. Your plan and the drugmaker pay the rest until you get through the gap. - Does the coverage gap happen every year?

Yes, the structure of the Part D benefit resets every calendar year. Whether you enter the gap depends on your drug costs each year. - Does the coverage gap happen every single year?

Yes, the Part D benefit design includes the coverage gap phase each calendar year. Whether you actually enter it depends on your prescription drug costs for that year. - Does Medicare offer DME?

Yes, Medicare Part B covers DME when prescribed by your doctor. - What DME does Medicare Part B cover?

It covers medically necessary equipment. This equipment includes mobility equipment, diabetic equipment, therapeutic and other equipment. - Do Medicare Advantage Plans cover DME?

Yes, Medicare Part C plans must cover all the same equipment as Original Medicare. - Does Medicare offer bathroom safety equipment?

No. They aren’t covered by Medicare. - Does it cover home hospital beds?

Yes, if it’s confirmed by your doctor.